Last year, we set out to answer a notoriously difficult customer service and experience question: “Does CS/CX scale?” Popular wisdom—not to mention recent news stories covering the service woes of large DTC (direct-to-consumer) brands—answers with a disheartening, “No.”

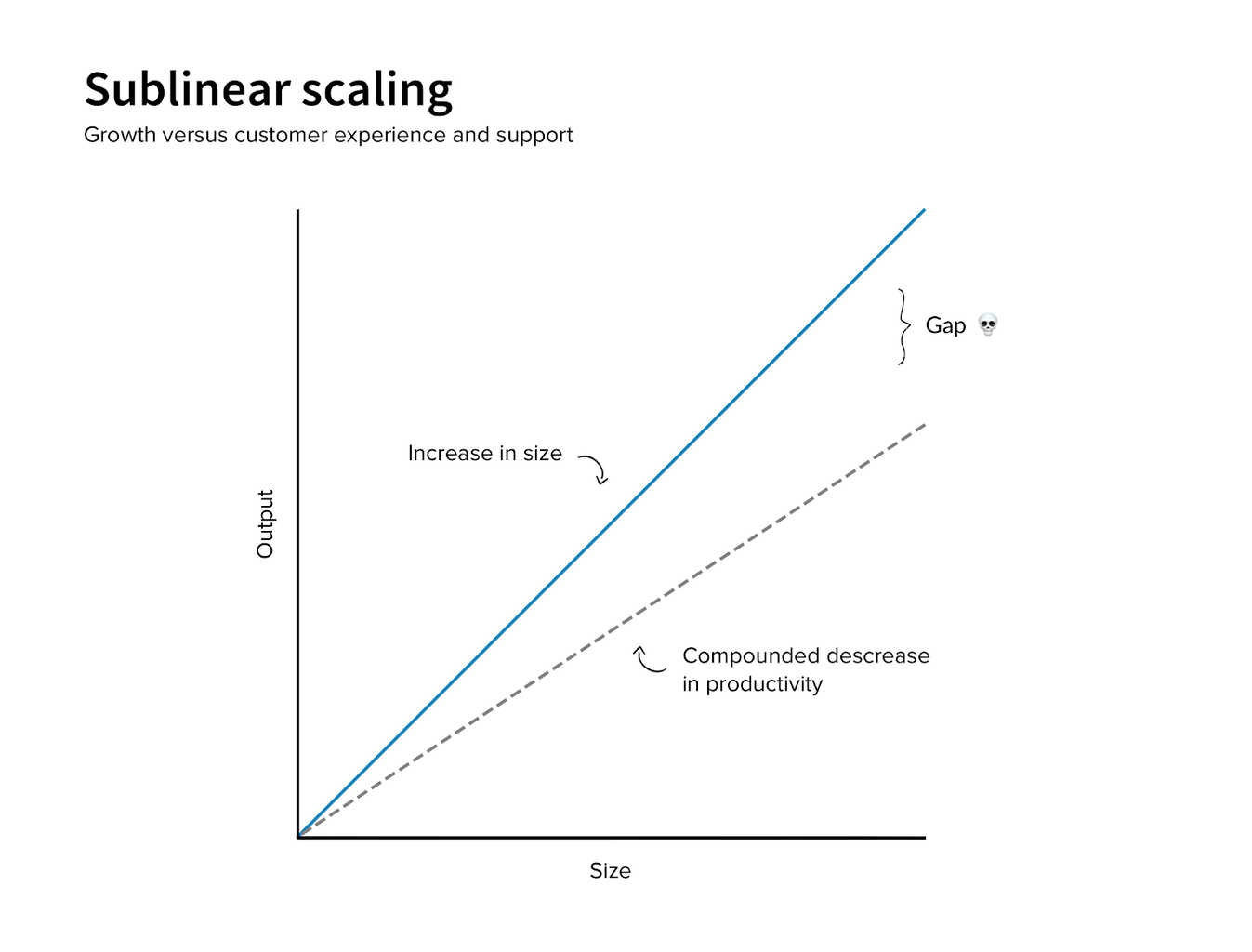

As companies grow, customers suffer. Put more academically, CS/CX scale sublinearly to size. The larger a brand gets and the faster its growth rate, the more support and experience lag behind. A gap appears between the two, ever-widening… until growth undoes itself.

Or does it?

At Zendesk Relate 2020, we’d planned to unveil How to Scale Ecommerce Customer Support Without Sacrificing Customer Experience—a first-of-its-kind study into the relationship between customer experience, customer support, and ecommerce growth divided into three parts:

Scale and Service across 1,000+ Brands: Does Size Matter?

The State of CX/CS: Data from 233 Brands ($25M-$1B+)

Guidance from the Frontlines and 10 Trends for the Future

Even though the conference was canceled, you can still sign up to get access to the report.

While the study contains a wealth of insights, perhaps the most startling was a contradiction we didn’t see coming. The number one metrics customer support (CS) professionals track and report upon were simultaneously rated the least actionable by the leaders we interviewed one-on-one.

Instead, those leaders pointed to three alternatives.

The larger a brand gets and the faster its growth rate, the more support and experience lags behind.

What are the most tracked CS metrics?

To determine the KPIs ecommerce companies from $25 million to over $1 billion pay attention to, we asked two questions:

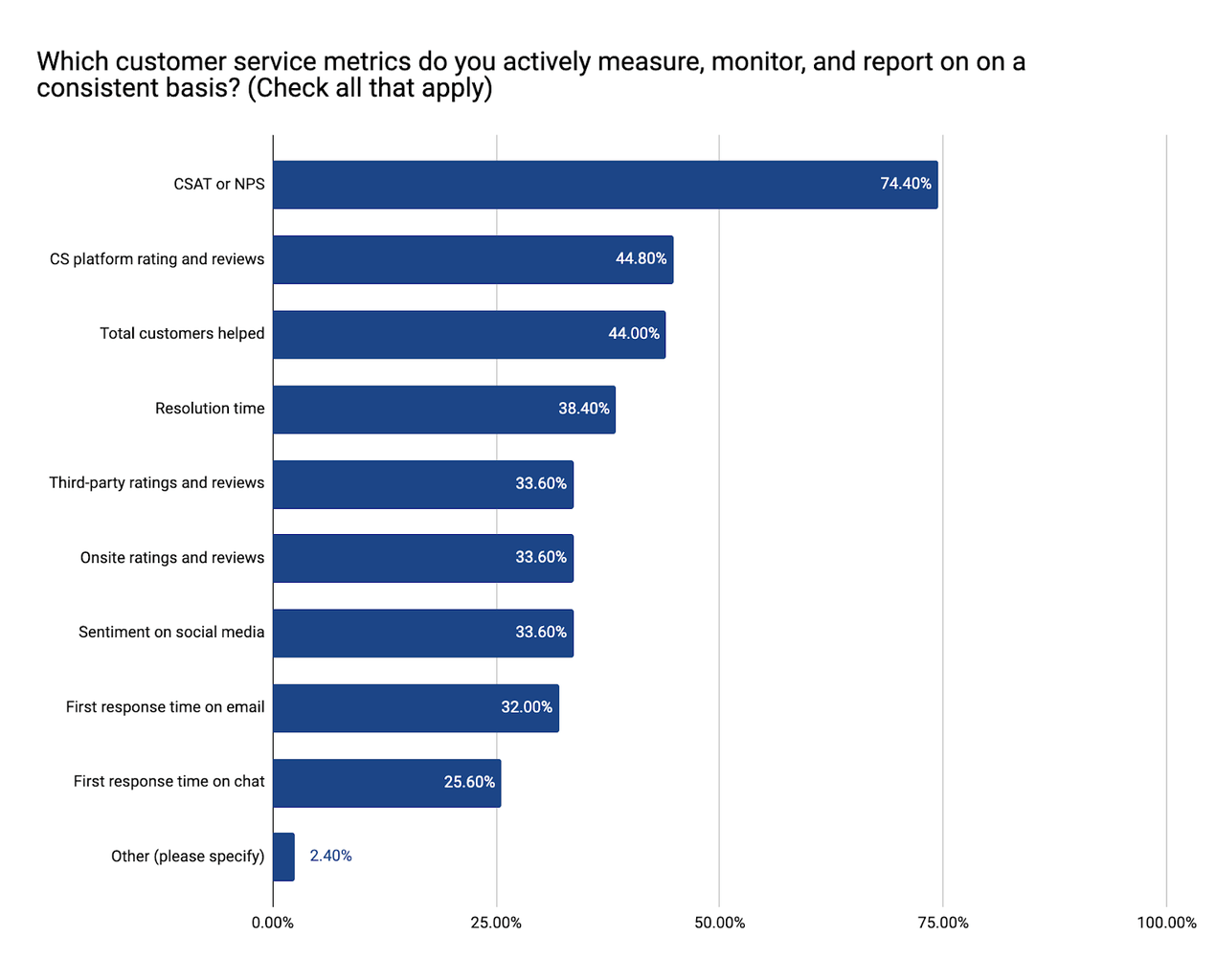

Which customer service metrics do you actively measure, monitor, and report on a consistent basis?

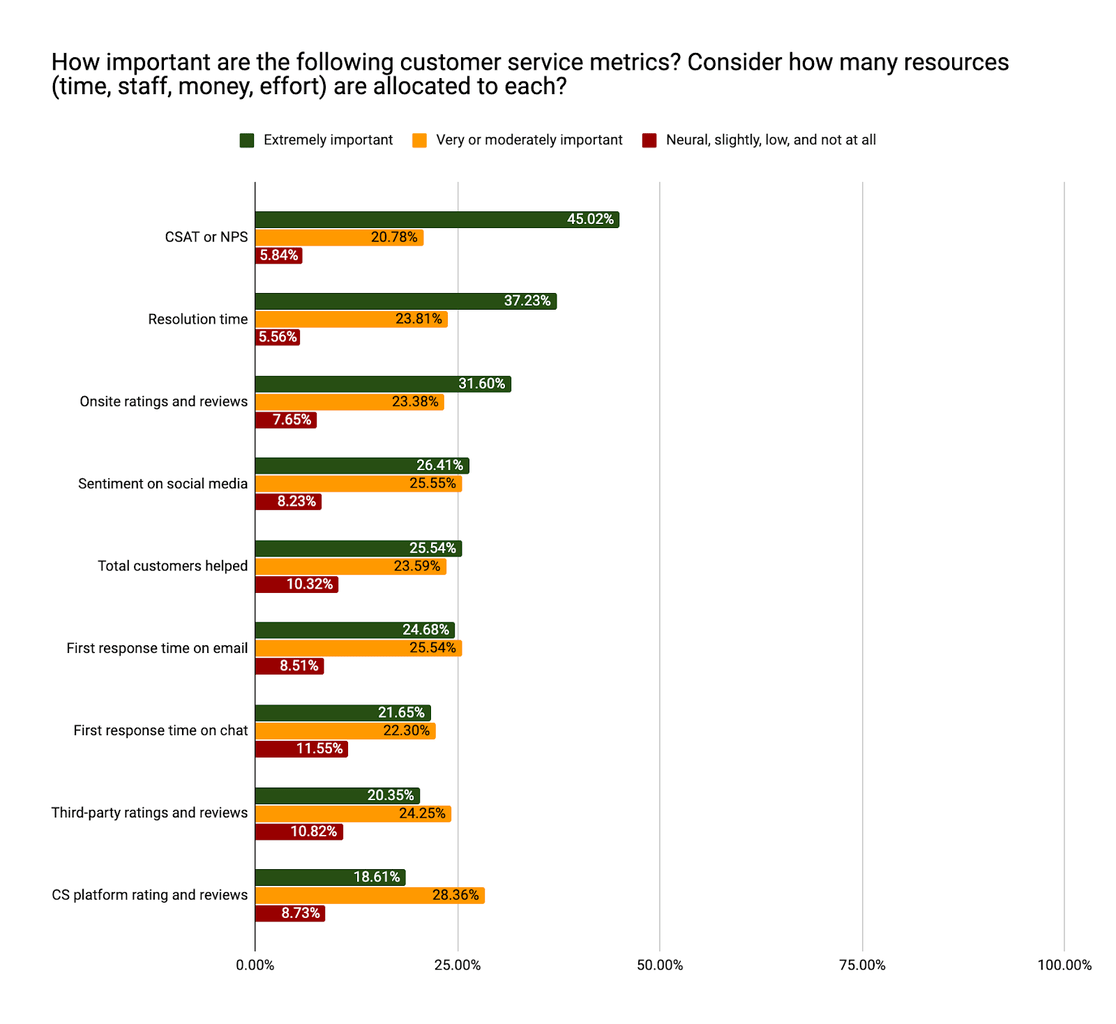

How important are the following customer service metrics? Consider how many resources (time, staff, money, effort) are allocated to each?

The first was meant to be a catchall focused not only on the metrics CS professionals use within their teams, but also the metrics they’re responsible for reporting on within their organizations. Here, one clear winner emerged:

The second question was designed to take another pass at the first, this time zeroing in on the actionability of those same metrics. As an indicator for action, we chose resource allocation. Interestingly, where “CSAT or NPS” won by a landslide in the first question (74%), its pride of place slipped considerably in the second version (45%) — a delta of nearly 30 percentage points.

Deviations between companies of different revenue sizes appeared in many of the other questions related to channels, challenges, and staff. Not so with customer satisfaction (CSAT) or Net Promoter Score (NPS).

[Related read: The best CX metric to drive your business]

The trouble with CSAT & NPS

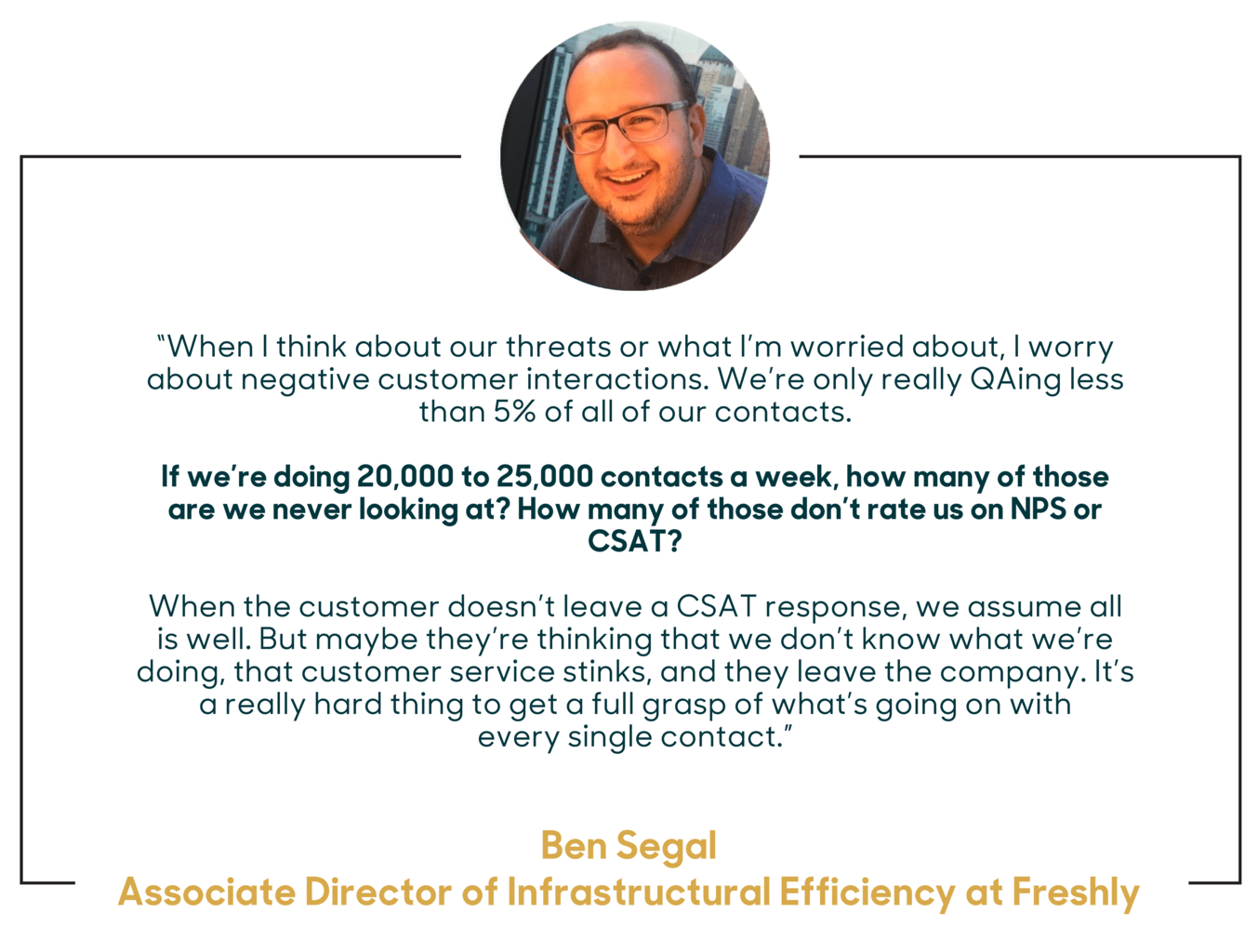

During the qualitative phase of the study, we interviewed ten CX/CS leaders at high-growth online retailers — ranging from $10M-$50M in annual retail revenue to over $100M.

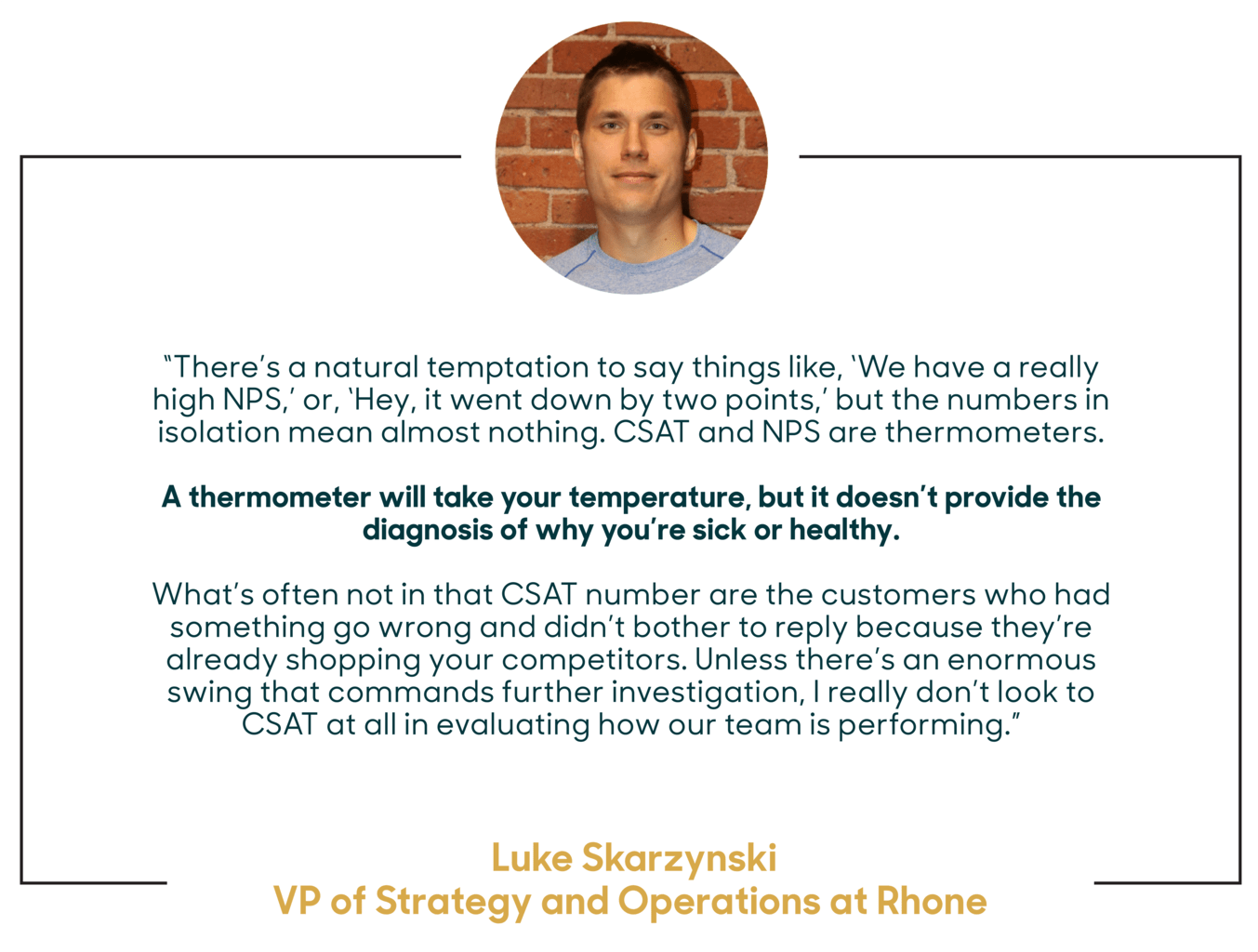

While most cited CSAT and NPS in their hierarchy of metrics, when asked, “Is there a commonly tracked metric in the industry you think is pure vanity?” without exception, doubts about those same metrics surfaced. These doubts clustered around three concerns: (1) lack of actionable insight, (2) often inflated positive results, and (3) dangerously low sample sizes.

Here’s what a few leaders had to say.

At scale, those limitations and worries only compound.

3 CS metrics that fuel growth

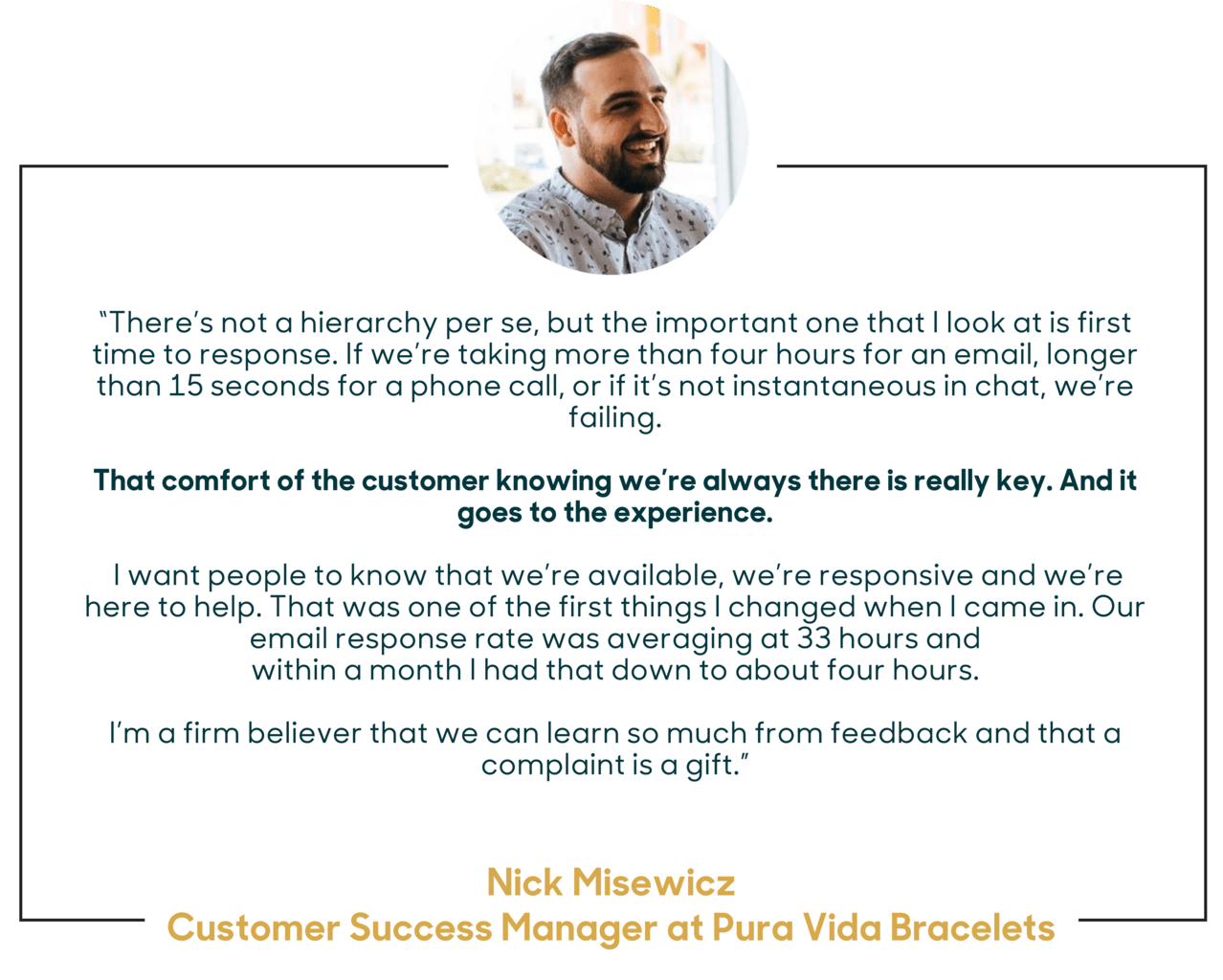

1. First response time as the leading indicator

Among the selectable metrics that CS leaders “measure, monitor, and report on,” first response time on email and chat, respectively, ranked dead last. Why include it here?

Because when it came to resource allocation broken down by revenue range, first response time’s importance jumped considerably.

What’s more, in the interviews, three of the ten specifically called out first response time as their “north star” in their dedicated journey of improving customer service. In addition to those three, one of the enterprise leaders’ insights on this front warrants citing in full.

2. Retention and sales as table stakes

A plethora of data already exists on the relationship between customer service and the value of customers in terms of revenue. Real-time support is especially powerful on this front.

And yet, despite the fact that CS engagements improve retention, sales, and Customer Lifetime Value (CLTV), only a slim majority said increasing engagements is “a priority” (57%). Large companies — between $100-$200 million and $200-$500 million — were the most aggressive on this lever at 62% and 64% respectively.

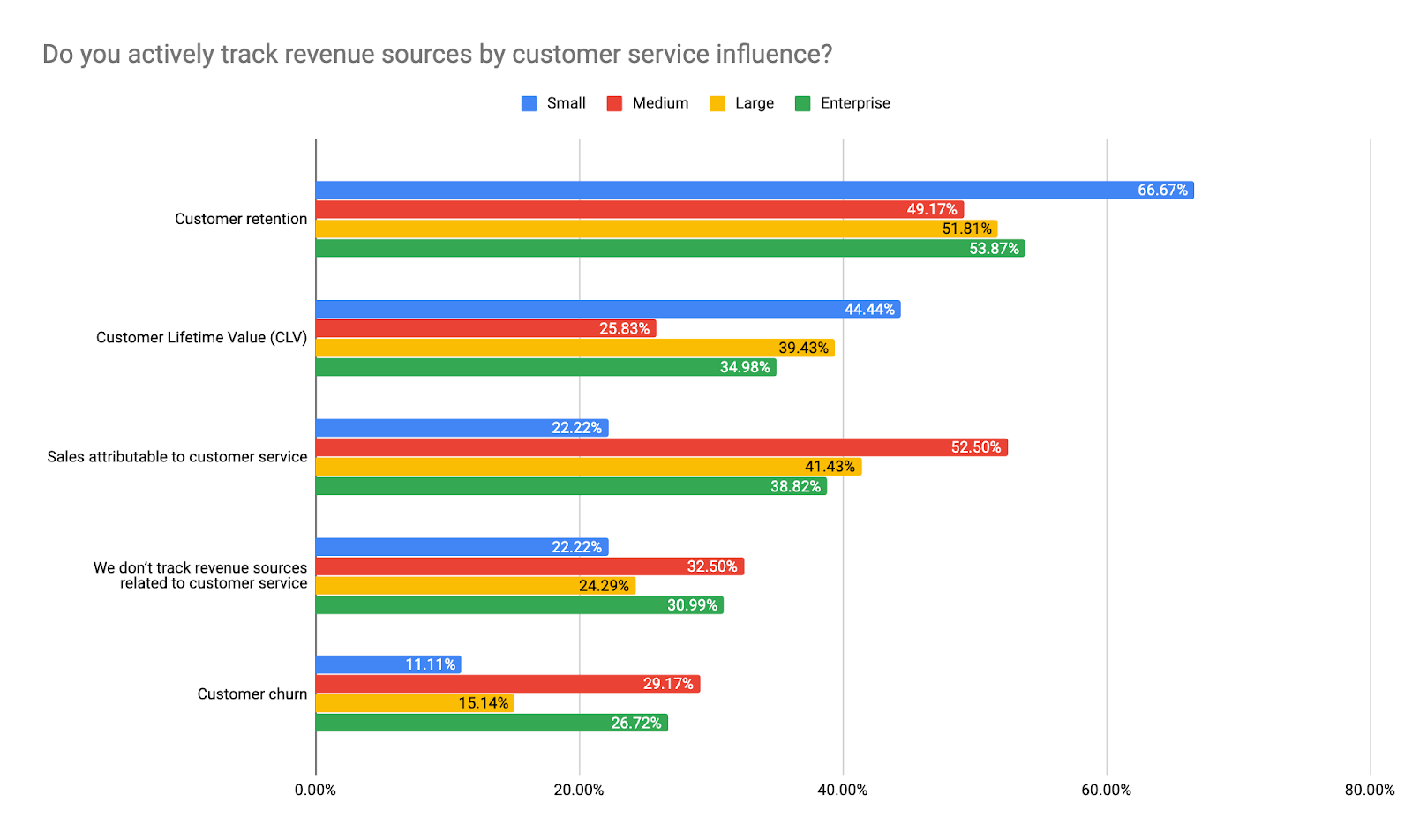

The reason goes right back to metrics. Over a quarter of online retailers reported that they “don’t track revenue sources related to customer service” (28%). In aggregate, customer retention was the lone exception to an otherwise monetary-metric minority.

Do you actively track revenue sources by customer service influence? Check all that apply:

Customer retention: 55%

Sales attributable to customer service: 38%

Customer Lifetime Value (CLTV): 37%

We don’t track revenue sources related to customer service: 28%

Customer churn: 23%

Divided along revenue ranges, here’s what the data showed:

Two lessons bear emphasizing on this point. First, sales and customer service can easily be connected, with the right tools. Solutions that provide a unified view of the customer, and easy integrations, allow customer service teams to see relevant account data, renewal cycles, and so forth, and provide sales reps with context into the service history and health of a customer’s account—vital knowledge before attempting an upsell or contract renewal.

Second, shifting your reporting to the metrics that drive business — particularly at high-growth DTC brands were customer acquisition and revenue reign supreme — legitimizes CS/CX’s contribution, budget, and voice to the wider organization.

“Getting a seat at the company table was difficult. I’ve been here over three years now, and — at the very beginning — there was no interaction with CX. It was a lot of pitching to the different heads, explaining how letting us in the room would help and benefit them… What really matters is speaking to other parts of the org in their language, their numbers.”

Ben Segal, Associate Director of Infrastructural Efficiency at Freshly

[Related read: Support leader or data analyst? Why data analysis is an essential CX skill]

3. Customer lifetime value as the future of scale

Beyond retention and sales, just over a third of brands track customer lifetime value (CLTV) as it relates to CS (37%). Tragically, this is by far the most crucial metric for long-term growth. Or, framed more positively — as Luke Skarzynski from Rhone did:

“The one that matters most to us is lifetime value. That’s our north star because it’s difficult to game and it’s the lifeblood of the business. We track other metrics — like NPS, repeat buyers, repeat rates by product, and return rates by product and by AOV, to name only a few. But these are all derivatives of lifetime value, and so we always start with lifetime value first.

“If we have strong lifetime value metrics in relation to our cost of acquiring and retaining customers, we know, almost by definition, all these other things are falling in place.

“Other metrics can be leading indicators suggesting whether the business might move one way or the other, and we will use them to help peel back the onion. But fundamentally, in every case, it all comes back to lifetime value.”

Luke Skarzynski

How can you bridge the gap?

One solution is to begin coordinating tickets with CLTV. Mott and Bow, for instance, does this by pulling sales data from Shopify and cross referencing whether or not a customer has submitted a support ticket via Zendesk in the last two years. The results vividly display the value of customer support interactions: ~2x-3x in real dollars.

“If causality follows,” noted Taylor Holiday, CEO of Common Thread Collective — the agency who manages Mott and Bow’s growth strategies, “the directive becomes: How much should you be willing to pay to get a CS interaction? Should you add intentional friction to the purchase and fulfillment funnel? Should you target recent customers with CS messaging via paid advertising? If the cost of creating that interaction is less than the delta in LTV, absolutely.”

A bold gamble? Only if the metrics don’t add up.

Want even more data and insight? Read the full study: How to Scale Ecommerce Customer Support Without Sacrificing Customer Experience.

Vincent Phamvan is the Chief Marketing Officer at Simplr, where he helps brands & retailers scale their consumer experiences through top-notch human + AI powered customer service. Vincent is an Official Member of the Forbes Council and a 40 Under 40 award recipient by Nashville Business Journal. His innovation work has been featured in Forbes, Entreprenuer.com, Fast Company, The Tennessean, and STORES Magazine by NRF.