Insurance CRM

Using a CRM for your insurance agency ensures you’ll stay competitive in a saturated market—here’s why.

Insurance CRMs background

อัปเดตล่าสุด July 12, 2023

The global insurance market value is expected to hit $5.938 billion in 2022. As a direct result of COVID-19, premiums are at an all-time high as many try to prepare for future disasters while coping with new and pre-existing medical conditions, environmental threats, and considerable debt.

These factors put insurance agencies into a bit of a conundrum: many people need insurance, but due to rising costs and disasters, the insurance industry is losing the trust of the average buyer.

Agencies don’t necessarily have control over the cost of policies. What they do have control of is the efficiency and efficacy of their internal systems and external brand. A CRM is the comprehensive software tool that helps you win sales by improving customer experience, organization, outreach, and market understanding.

Keep reading to discover:

- Why insurance agents and brokers need CRM software

- Insurance CRM applications

- Insurance CRM benefits

- Best insurance CRMs at a glance

- 7 best CRMs for the insurance industry

- The importance of CRM customization for insurance agencies

Why insurance agents and brokers need CRM software

Insurance software has a niche in the SaaS market. Fantastic insurance platforms are available in all cost brackets for different-size companies, providing tools focused on policy management, billing, rating, underwriting, and reporting. However, these software offerings—even the ones with sales capabilities—lack the power of a dedicated customer relationship management (CRM) platform.

Because the insurance industry requires so much attention to detail, it’s common for brokers and agencies to get wrapped up in the financials and qualifications. That makes it easy to forget about lead generation, nurturing, and the importance of customer communication and experience. CRMs for insurance agencies work to fix that gap.

At the end of the day, the insurance industry is a sales industry. That means insurance companies and brokers need to prioritize the customer experience as much as general retailers. Whether you sell life rafts or life insurance, the most important aspect of your business is always going to be managing prospect and customer relationships. This is especially true in the insurance industry where the customer satisfaction level is only 29 percent.

The easiest way to make these changes is with the automation and organization of a quality sales CRM.

Insurance CRM applications

CRMs benefit all sales teams, but particular CRM tools can enhance the sales process of insurance companies in unique ways. Let’s take a look.

Lead generation

According to Yoann Michaex, the insurance lead for IBM iX, “The biggest roadblock with [selling insurance] to the population remains a mix of interest, understanding, and perceived complexity.” That complexity combined with the fact that 2022 is expected to be the fifth consecutive year of higher premium costs means that insurance lead generation is no easy feat. Between rising costs, waning interest, and a general distrust of the industry, leads are pulling away from insurance.

That means insurance agencies need reliable ways to generate and qualify leads before they can even start the sales process. CRMs are invaluable for producing and tracking website lead forms, email marketing, and advertising efforts to give agencies access to a larger audience. Most people these days, especially those under 40, are not going to seek out insurance information on their own. With lead generation tools, you can reach out to them directly.

Lead management

Finding a lead is only step one. In a perfect world, you wouldn’t have to nudge your leads through the sales pipeline, but unfortunately, immediate buyers are rare. Most prospects need a bit of nurturing to get them to the final sale. CRM lead management tools give brokers a complete picture of their clients and where they stand in the sales journey.

With that knowledge, your agency can use tools like automated outreach, personalized scripts, and prompt communication to decrease churn along the pipeline and increase conversion rates. Don’t just lay the deal out on the table: speak to precisely why this policy will benefit your lead.

Contact management

The more data you have on a prospect or client, the easier it is to understand their pain points, appeal to their needs, and ultimately make a sale. CRM contact management tools allow you to store client information and behavior markers. These include:

- Names

- Companies

- Contact details

- Email history

- Call history

- Quality of past interactions

- Purchase history

Armed with this data, it’s much simpler to approach an interaction. Personalized conversations lead to memorable customer experiences. When you can provide a “Wow, they remembered that about me!” moment, sales rates, brand loyalty, and customer satisfaction increase.

Reporting and analytics

Data reports and forecasts are essential tools for the insurance industry. Not only do they provide insights into the state of the market, they also help you track KPIs, sales goals, and activity successes. Insurance software will usually track some of these things, but CRMs are more comprehensive—and therefore much more valuable.

For instance, your insurance software may tell you that your March sales were higher than your February sales. That’s useful information, but it doesn’t do you much good unless you know the why. CRM reports let you dig into the details: did you use more outreach emails? Did you personalize more? Did you add a lead channel? What specific behavior changed in your sales that helped increase them? When you can answer those questions, you can solidify the changes that worked and alter (or discard) the strategies that didn’t.

Insurance CRM benefits

Certain CRM features greatly benefit insurance sales, but they also provide overall benefits to company productivity.

Sales automation increases productivity

One of the reasons insurance agents and other highly technical sales reps struggle with customer relationships is that they’re bogged down with paperwork. Sales automation saves insurance agents time and brain space by taking care of any mundane or repetitive tasks. This leaves them far more time to focus on client care.

Increased productivity drives revenue

Increased focus on client care means more personal customer experiences and a faster journey through the sales process. Happier customers purchasing at a higher rate means your revenue will reap the benefits.

Improved customer experience and retention

Customers who feel cared for by their insurance brokers are more likely to make a purchase and more likely to stay loyal to your company. After all, insurance is an industry where a one-time sale doesn’t mean much if the client won’t stay with you for years to come. A positive experience ensures customers will continue with your policy, even if a potentially cheaper option comes along.

Best insurance CRM at a glance

Product | Pricing | Features |

|---|---|---|

Zendesk Sell |

14-day Free Trial Free demo available Team: $19/user/month Growth: $55/user/month Professional: $115/user/month Enterprise: $169/user/month |

|

FreeAgent |

No free trial Starter: $29/month - 500 transactions Professional: $295/month - 5,000 transactions Enterprise: $795/month - 20,000 transactions |

|

Oracle |

No free trial Oracle Cloud Infrastructure Oracle Cloud Applications Contact company for quotes on all products |

|

AgencyBlock |

Free demo available Plans start at $70/month, contact company for a full quote |

|

Freshsales |

21-day free trial available Free: $0/user/month Growth: $15/user/month Pro: $39/user/month Enterprise: $69/user/month |

|

Zoho |

Free demo available Free: $0 up to three agents Standard: $14/agent/month Professional: $23/agent/month Enterprise: $40/agent/month |

|

Insureio |

30-day free trial available Basic: $25/month Marketing: $50/month Agency Management: $50/month Marketing and Agency Management: $75/month |

|

7 best CRMs for the insurance industry

Zendesk Sell

Zendesk Sell is a top-tier CRM that brings robust CRM features together with financial data services. With omnichannel communication tools that connect to social media and your call center, you can rest assured that your leads and customers are accessible at every level.

While applicable to any type of business, Zendesk also offers tools ideal for insurance agencies. These include script suggestions during calls, sales goal tracking and KPIs, and full sales automation tools throughout the sales pipeline that help agents stay on top of their leads. Zendesk also integrates with hundreds of apps and third-party software offerings. No matter how complex your tech stack, it’s easy to link your data back to your CRM.

At Zendesk, scalable, customizable, user-friendly software is the name of the game. Whether you’re an individual agent just getting started or an established enterprise agency, Zendesk Sell streamlines your work so you can focus on your customers.

Features:

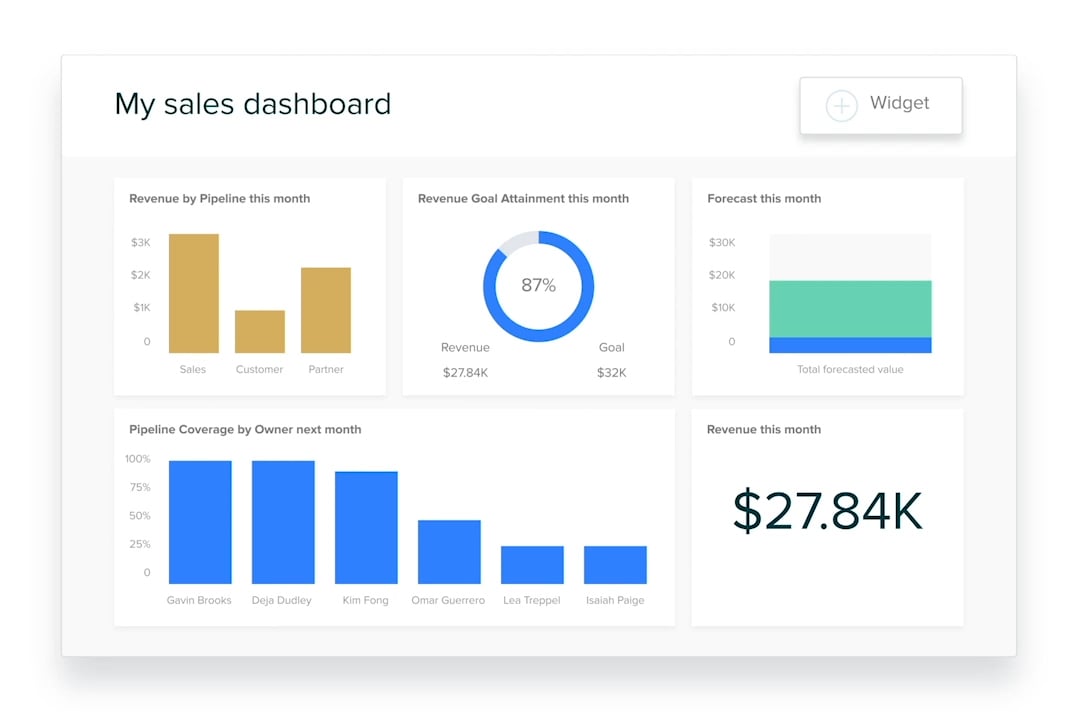

- Custom sales dashboards

- Goals tracking

- Reporting and analytics

- Sales forecasting tools

- Data management tools

- Lead management tools

- Lead generation tools

- Contact management

- Power dialer

- Script suggestions

- Email automation

- Pipeline management

- Easy integrations

Free trial/demo: 14-day free trial, free demo available

Pricing:

- Team: $19/user/month

- Growth: $49/user/month

- Professional: $99/user/month

- Enterprise: $150/user/month

FreeAgent

FreeAgent is a CRM platform designed to increase team alignment and sales pipeline efficiency. With customized dashboards and live activity tracking, FreeAgent helps teams stay on task and reach their sales goals—saving time and maximizing day-to-day productivity. This simple platform is also user-friendly, so you’re never lost trying to integrate apps or navigate the system.

FreeAgent’s billing platform is unique in that the company charges by transaction, not users. This makes it ideal for unwieldy teams who may have inconsistent usage of the tool. There are a couple of drawbacks for insurance agents and businesses, however. First, FreeAgent is designed for teams. That means it’s not ideal for an individual agent looking for a CRM. Second, because FreeAgent charges by transaction, if you run out before the end of the month, you’ll either have to pay more or delay transacting until a new billing period starts—and the price jumps are steep.

Features:

- Custom dashboards

- Reporting and analytics

- Data management tools

- Lead management tools

- Contact management

- Email automation

- Automated assignments

- Approval workflows

Free trial/demo: None

Pricing:

- Starter: $29/month - 500 transactions

- Professional: $295/month - 5,000 transactions

- Enterprise: $795/month - 20,000 transactions

Oracle

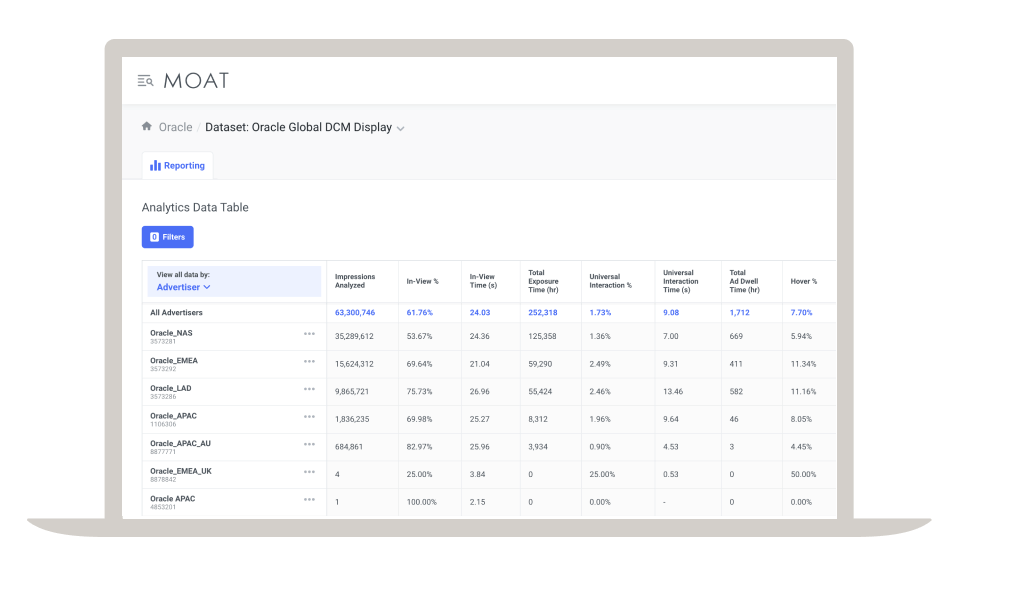

Oracle is a unique combination software that carries CRM capabilities but is more of an all-inclusive Cloud platform. Divided into Cloud Applications and Cloud Infrastructure, Oracle focuses on omnichannel access to all aspects of your business. From supply chain management tools to customer experience alignment, there’s very little Oracle can’t do.

Cloud Infrastructure, in particular, has a huge focus on analytics and digital services that can be a game changer for largely digitized companies and SaaS businesses.

However, too many features can be just as counterproductive as too few if you’re a single agent or small agency. Oracle is a highly regarded sales and service software choice, but if you’re looking to start small, it may not be the choice for you.

Features:

- Reporting and analytics

- Sales forecasting tools and risk management

- Data management tools

- Lead management tools

- Content management tools

- Pipeline and marketing management tools

- Cloud-based systems

- Financial management

Free trial/demo: None

Pricing: Contact company for quotes on all products.

AgencyBloc

AgencyBloc is a CRM solution specifically designed for life and health insurance agents and businesses. As an industry-specific CRM, it focuses on contact management, business books, policy management, and KPIs. AgencyBloc also includes CRM essentials like sales reporting and communication tracking.

While AgencyBloc is a useful industry-specific tool, it doesn’t come cheap—especially for individuals or smaller agencies. With a starting price of $70 a month, AgencyBloc is likely not the best choice for any agency that isn’t large or well established.

Features:

Reporting and analytics

Sales forecasting tools

Data management tools

Activity tracking

Task assignment

Lead management tools

Lead generation tools

Contact management

Email marketing

Policy tracking

Free trial/demo: Free demo available.

Pricing: Plans start at $70/month, contact the company for a full quote.

Freshsales

Freshsales offers two CRMs: a dedicated sales CRM and a combination sales and marketing CRM. For smaller insurance companies, its sales CRM is an affordable, feature-rich choice that focuses on lead generation and efficient sales pipelines.

Freshsales is a standout option for individuals and smaller operations because the free package actually includes a fair amount of features. While not robust enough to run an entire company, the free package is a great starter that includes contact and account management; contact lifecycle stages; built-in chat, email, and phone tools; and a mobile app.

Larger companies should note, however, that while Freshsales does scale in pricing and features, it does not hit the same all-inclusive scope as the larger players (Zendesk, HubSpot, and Salesforce).

Features:

- Custom sales dashboards

- Reporting and analytics

- Sales forecasting tools

- Data management tools

- Lead management tools

- Lead generation tools

- Contact management

- Email automation

- Pipeline management

- Easy integrations

- Sales sequences

- Activity timelines

- Product catalog

Free trial/demo: 21-day free trial available

Pricing:

- Free: $0/user/month

- Growth: $15/user/month

- Pro: $39/user/month

- Enterprise: $69/user/month

Zoho

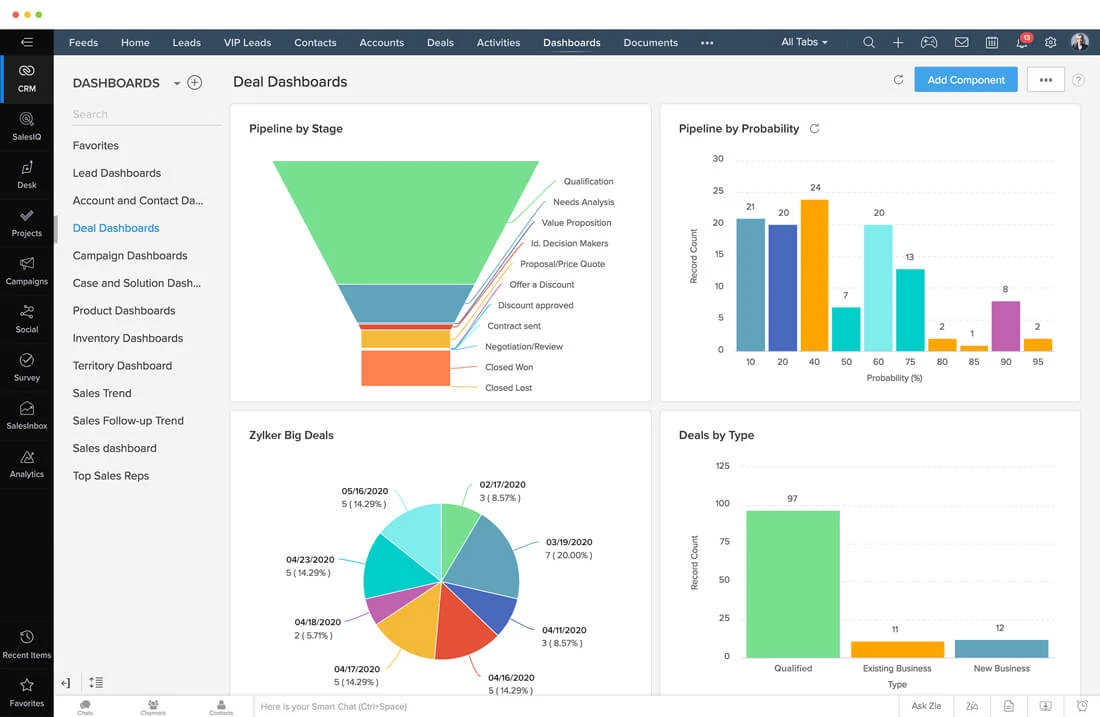

Zoho prides itself on a mastery of omnichannel communication that enhances the customer experience and increases customer loyalty. With an admirable list of features, Zoho uses segmentation, predictive intelligence, and buyer personas to deliver a highly personalized experience.

The company now also offers two additional CRMs designed for small businesses/individuals and enterprise companies. Zoho CRM Plus for large enterprises includes additional features focusing on visual reporting and detailed analytics as well as an omnichannel approach to communication. On the smaller side, Bigin is a small, pipeline-centric CRM focusing on user-friendly experiences and lower costs.

Features:

- Goals tracking

- Reporting and analytics

- Sales forecasting tools

- Data management tools

- Lead management tools

- Lead generation tools

- Contact management

- Email automation

- Pipeline management

- Easy integrations

- Workflow

Free trial/demo: Free demo available

Pricing:

- Free: $0 up to three agents

- Standard: $14/agent/month

- Professional: $23/agent/month

- Enterprise: $40/agent/month

Insureio

Insureio is a dedicated CRM for insurance companies and agents developed by experienced brokers. While it includes many CRM essentials, Insureio is primarily dedicated to insurance-specific activities such as client management, case management, and application fulfillment. In addition, Insurio delivers CRM must-haves with lead generation and nurturing tools as well as analytics and reporting programs.

There are two cons to Insureio. The focus on insurance functions (while fantastic for the insurance industry) means that Insureio isn’t equipped with as many sales and service features compared to large CRM competitors like Zendesk or Hubspot. Meanwhile, the lower tiers of Insureio are great for individual agents, but a full agency cannot run without investing in the top tier at $75/month.

Features:

- Reporting and analytics

- Data management tools

- Lead management tools

- Lead generation tools

- Contact management

- Email automation

- Pipeline management

Free trial/demo: 30-day free trial available

Pricing:

- Basic: $25/month

- Marketing: $50/month

- Agency Management: $50/month

- Marketing and Agency Management: $75/month

The importance of CRM customization for insurance agencies

The insurance industry faces unique challenges in the sales world, especially coming out of a pandemic that changed the way the population looked at health and life insurance. That’s why it’s essential that your insurance CRM is flexible and customizable.

For example, Zendesk Sell is not only scalable based on the size of your company—it also partners with a robust marketplace of add-on tools and functions. If your company already uses certain tech or needs to add certain tools, Zendesk integrates with over 300 applications to keep your data streamlined and accessible.

Zendesk Sell also works with a long list of partners that can help shape your CRM experience based on your company’s needs. A great example of this is the partnership with Aktie Now, which designs customized customer service tools based on your process and target audience.

Incorporate a CRM into your insurance agency today

A full 91 percent of sales organizations with 10 or more employees use a CRM. Insurance is sales. If you’re one of the 9 percent left behind, you’re already falling behind your top competitors in the insurance market in 2022.

Luckily, with a 14-day free trial, you don’t have to wait to give an insurance CRM a try. Zendesk Sell is readily available for a test drive for businesses of all sizes, from small nonprofits to enterprise-level insurance agencies. Request a demo of Zendesk Sell today and see how customer relationship management transforms your sales process.